Please refer to the image below showing how the EPF sees how one grows. The Employees Provident Fund EPF announces that the quantum for the Basic Savings will be revised from the current RM228000 to RM240000 effective 1 January 2019.

Should You Consider Withdrawing Your Epf Savings For 2022 Black Belt Millionaire

KUALA LUMPUR 28 November 2018.

. How Social Security Code 2019 Will Impact Employees Gratuity Protect Their Epf Dues Savings And Investment Investing For Retirement Savings Strategy 29 June 2020 Saving For Retirement Institution Universal 30 Nov 2020 Bar Chart Chart 10 Things Pin On Epfo Pf And Uan All Informations How To Do Epf E Nomination With Beneficiary Aadhaar Photo Investment In India. This amount is has been calculated to be sufficient for Malaysians to survive for 20 years after. Basic Savings is a pre-determined amount set according to age in Account 1 to enable members achieve a minimum savings of at least RM240000 when they reach age 55.

The last revision took effect in 2017. The Employees Provident Fund has announced a new target amount for Basic Savings that it hopes each Malaysian will be able to save by age 55. The quantum for the Basic Savings will be revised from the current RM228000 to RM240000 the minimum target EPF basic savings members should have upon reaching age 55.

Kumpulan Wang Simpanan Pekerja KWSP hari ini mengumumkan bahawa kuantum baharu Simpanan Asas akan dinaikkan daripada RM228000 kepada RM240000 bermula 1 Januari 2019Jumlah ini akan ditetapkan sebagai jumlah sasaran simpanan minimum ahli perlu ada. Dato Mohamad Nasir said With the revision in the quantum of Basic Savings from RM228000 to RM240000 at Age 55 effective 1 January 2019 members will now accordingly be required to have higher savings in their EPF account in order to be eligible to participate in the EPF MIS The new quantum is benchmarked against the minimum pension for public sector. What are the changes affecting EPF basic savings.

The amount will be set as the minimum target EPFs basic savings members should have upon reaching age 55 the pension fund said in a statement yesterday. 20 rows New Basic Savings Quantum Begins January 2019. Effective 1 January 2019 the target savings for EPF members will be raised from RM228000 to RM240000.

The amount will be set as the minimum target EPF basic savings members should. The latest EPF basic savings will take effect on Jan 1 2019. 664 views 13 likes 0 loves 1 comments 11 shares Facebook Watch Videos from My Personal Finances.

Kuantum Baharu Simpanan Asas Bermula Januari 2019. Check Your EPF Balance. The basic savings refers to.

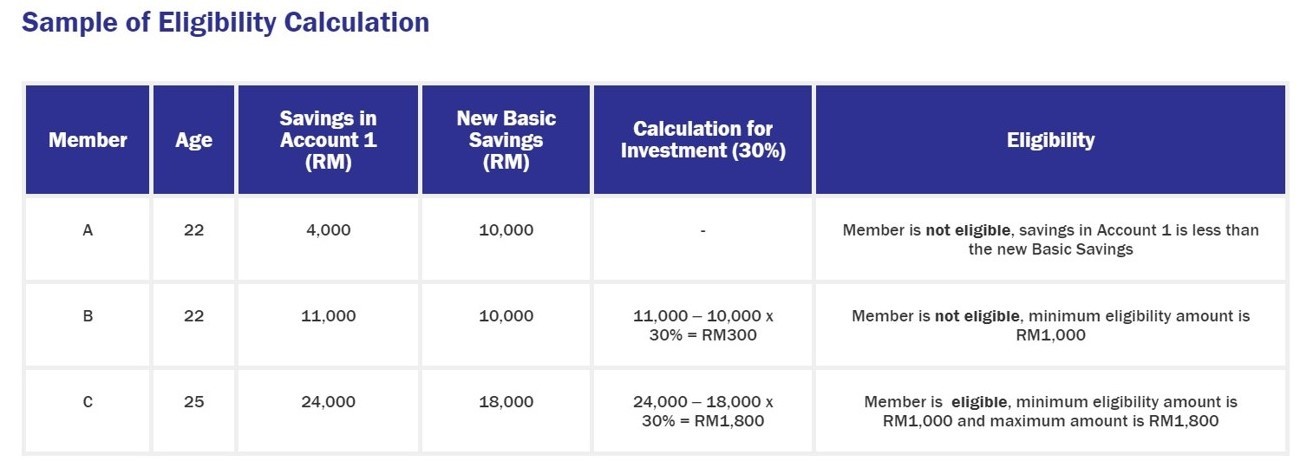

Heres a rundown on how you can withdraw from EPF to invest in Members Investment Schemes and calculate potential gains or risk losses. The Pension Scheme 1995. The Employees Provident Fund EPF will be revising the quantum for basic savings from the current RM228000 to RM240000 effective Jan 1 2019.

TDS Tax Deducted at Source is applicable on pre-mature EPF Employees Provident Fund withdrawals of Rs 50000 or more with effective from June 1st 2015. KUALA LUMPUR 28 November 2018. According to EPF the basic savings refer to the amount that is considered sufficient to support members basic retirement needs for 20 years from age 55 to 75 aligned.

The basic savings represents the amount. If you earn more than RM34000 a year youre not going to escape paying. Free Malaysia Today.

Prior to reaching age 55 members are not allowed to withdraw their savings. Heres a rundown on how you can withdraw from EPF to invest in Members Investment Schemes and calculate potential gains or risk losses. The EPF Scheme 1952.

The Basic Savings quantum is benchmarked against the minimum pension of RM1000 per month to support members basic. EPF to revise members basic savings to RM240000 effective Jan 1 2019 from current RM228000. The Employees Provident Fund EPF is revising the quantum for basic savings from the current RM228000 to RM240000 effective Jan 1 2019.

Through the EPF account money-saving has been done. How can you withdraw from EPF to invest in EPF Members Investment Schemes. The new quantum for the Basic Savings in EPF Account 1 will be revised from RM228000 RM 950 per month for 20 years to RM240000 RM1000 per month for 20 years at members age of 55 years old.

Heres a rundown on how you can withdraw from EPF to invest in Members Investment Schemes and calculate potential gains or risk losses. What are the changes affecting EPF basic savings starting January 1st 2019.

Indian Household Savings Investments 2019 20 Rbi S Data

Tour F12 Epf Alpine Touring Binding 2022 Ski Bindings Skiing Touring

The Impact Of The New Basic Savings Table For Epf Members Investment Scheme Effective Jan 2014 Myunittrust Com

Finance Malaysia Blogspot Epf Mis Revised Basic Savings Table Effective Jan 2019

2019 Epf Updates Include Decreasing Senior Staff Contribution To 4

Epfigms How To Register An Epf Grievance Online

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

Epfo Investments Commissioner To Get Power For Prompt Decisions The Financial Express

How Social Security Code 2019 Will Impact Employees Gratuity Protect Their Epf Dues Savings And Investment Employee Benefit Coding

How To Do Epf E Nomination With Beneficiary Aadhaar Photo Investment In India News Online Stock Market Investing

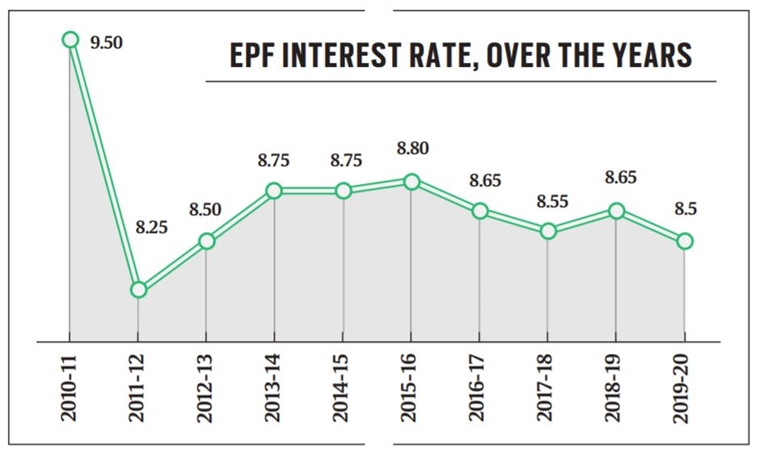

Labour Ministry Notifies 8 65 Interest Rate On Epf For 2018 19 Interest Rates Growing Wealth Personal Finance

How To Diversify Grow Your Epf Savings Psst Tell Your Parents About It Too No Money Lah

Pin On Epf Kwap Ltat Lth Pnb Ptptn

Finance Malaysia Blogspot Epf Mis Revised Basic Savings Table Effective Jan 2019

How To Save Rs 10 Crore For Retirement Without Taking Too Much Risk Investing Money Saving Tips Self Improvement Tips

Kwsp Epf Sets Rm228 000 As Minimum Target Savings At Age 55

Employees Provident Fund Epf Interest Rate Withdrawal Rules 2019 20 Should You Dip Into Your Epf